What Are the Product Compliance for Amazon Australia?

With the booming development of online shopping demand in Australia, Amazon, as one of the world's leading e-commerce giants, attracts over 80% of Australian consumers to shop on its platform.

In this issue, we have compiled the key compliance requirements and various certification requirements for Amazon Australia for you~

Amazon Australia · Australian GST

What is Australian GST?

Goods and Services Tax (GST) is a type of value-added tax in Australia. It has been levied on certain goods imported into and sold in Australia since JULy 1, 2017.

According to Australian tax laws, GST applies to imported services and digital products sold to Australian resident consumers, as well as imported low-value goods (i.e., goods with a value not exceeding AUD 1,000) sold to Australian customers.

This regulation means that GST will be imposed on transactions where your Australian customers purchase the aforementioned goods or services from overseas through the Amazon e-commerce platform.

*Unlike many other countries, GST on imported low-value goods is not collected at the time of importation.

Who Must Register for Australian GST?

Sellers on Amazon Australia are requiRED to register for a GST number with the Australian Taxation Office (ATO) within 21 days if their annual sales exceed AUD 75,000 (approximately RMB 350,000) in a 12-month period.

If sales are below this threshold, sellers may choose to register for GST voluntarily. If deregistration is required, an application must be submitted to the ATO 21 days before the cessation of business.

*The standard Australian GST rate is 10%.

Details of Australian GST Registration and Reporting

(1) Registration Methods

Simplified GST Registration:

Does not require an Australian Business Number (ABN). Registrants will obtain an Australian Registered Number (ARN).

This method is generally applicable to non-resident entities that do not have a physical presence in Australia, do not engage in local warehousing, and only sell imported services, digital products, or low-value imported goods.

Standard GST Registration:

Requires an Australian Business Number (ABN).

It applies to all Australian businesses that meet the GST registration threshold and some non-resident entities, such as businesses conducting physical operations in Australia, issuing tax invoices, and wishing to claim GST credits.

Comparison of Features Between Simplified GST Registration and Standard GST Registration:

Simplified GST Registration | Standard GST Registration |

No ABN required | Possesses or requires an ABN |

Conducts sales related to Australia | Conducts sales related to Australia |

Sells imported services, digital products, or low-value imported goods | - |

Seeks a quick and easy electronic registration, reporting, and payment process | - |

Cannot claim GST credits (including credits for taxable imports) | Eligible to claim GST credits, required to issue tax invoices, and entitled to claim consumption tax credits |

*For sellers on Amazon Australia, if goods are shipped directly from overseas, the simplest option is to register for the Simplified GST system.

(2) Required Documents for Registration

1. Australian GST Application Service Information Form

2. Business License

3. Passport / Birth Certificate - Primary Identification

4. Legal Person ID Card / Household Register / Driver's License - Secondary Identification

5. Backend Platform Information

*All scanned copies of documents must be clear and neatly organized!

(3) Australian GST Reporting

Australia operates on a fiscal year system, with each fiscal year running from July 1 to June 30 of the following year. A new fiscal year commences on July 1, meaning you may submit your tax return starting from June 30.

Quarter 1: July – September

Quarter 2: October – December

Quarter 3: January – March

Quarter 4: April – June

Amazon Australia · Updated Compliance Requirements

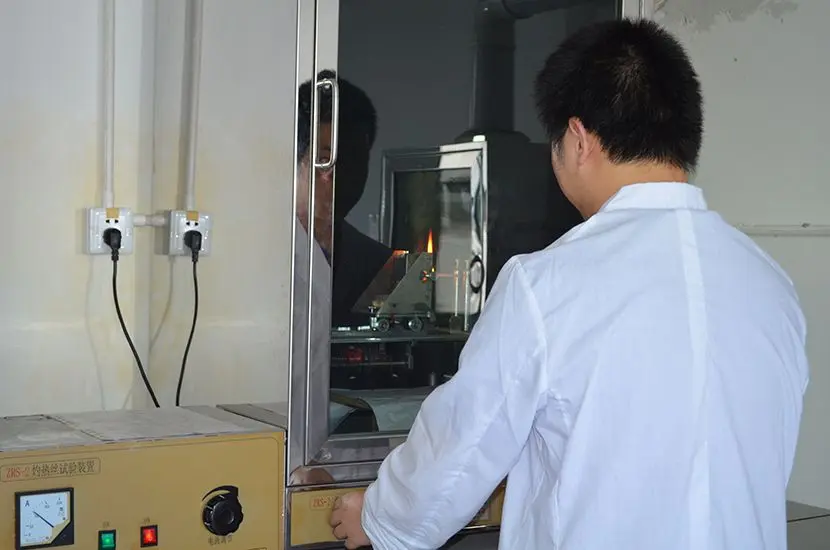

1. Standalone Button Cells and Coin Cells, and Products Containing Button or Coin Cells

(1) ACCC Safety Requirements

The Australian Competition and Consumer Commission (ACCC) has established safety requirements for all consumer products containing button or coin cells (including storage containers and storage boxes):

① Must bear clearly marked warnings and labels

② Batteries must be securely fixed

③ Batteries must not become loose during reasonably foreseeable use or misuse of the product

*This regulation also applies to accessories of consumer products containing button or coin cells (such as remote controls), which are also required to undergo compliance testing.

(2) Certification Requirements

Standalone button cells and coin cells, as well as products containing button or coin cells, shall comply with the following requirements:

① The Consumer Products (Button/Coin Batteries) Safety Standard in the Consumer Products (Button/Coin Batteries) Safety Standard 2020

② The Consumer Products (Button/Coin Batteries) Information Standard in the Consumer Products (Button/Coin Batteries) Safety Standard

2. Approved Medical Devices and Accessory Products

Medical devices generally refer to various products that exert physical or mechanical effects on the body, or are used to measure (or monitor) the body and its functions, such as medical gloves, bandages, syringes, blood pressure monitors, and X-ray equipment.

(1) Examples of Approved Products for All Sellers

① Eyeglass frames

② Condoms

③ Bandages

④ Pregnancy test kits

⑤ Thermometers

⑥ Medical face masks

⑦ Transcutaneous Electrical Nerve Stimulation (TENS) devices

⑧ Non-implantable electrical incontinence devices

⑨ Cardiopulmonary resuscitation (CPR) masks

⑩ Continuous Positive Airway Pressure (CPAP) masks

⑪ Respiratory training equipment

⑫ Blood glucose monitors

⑬ Wearable electrocardiogram (ECG) monitoring devices

⑭ Snake venom extractors

(2) Regulatory or Standard Requirements

Product | Regulatory or Standard Requirements |

Medical Devices | All of the following:<br>• Listed in the Australian Register of Therapeutic Goods (ARTG)<br>• Therapeutic Goods Act 1989<br>• Therapeutic Goods (Medical Devices) Regulations 2002<br>• Therapeutic Goods Advertising Code |

Amazon Australia · Main Certifications

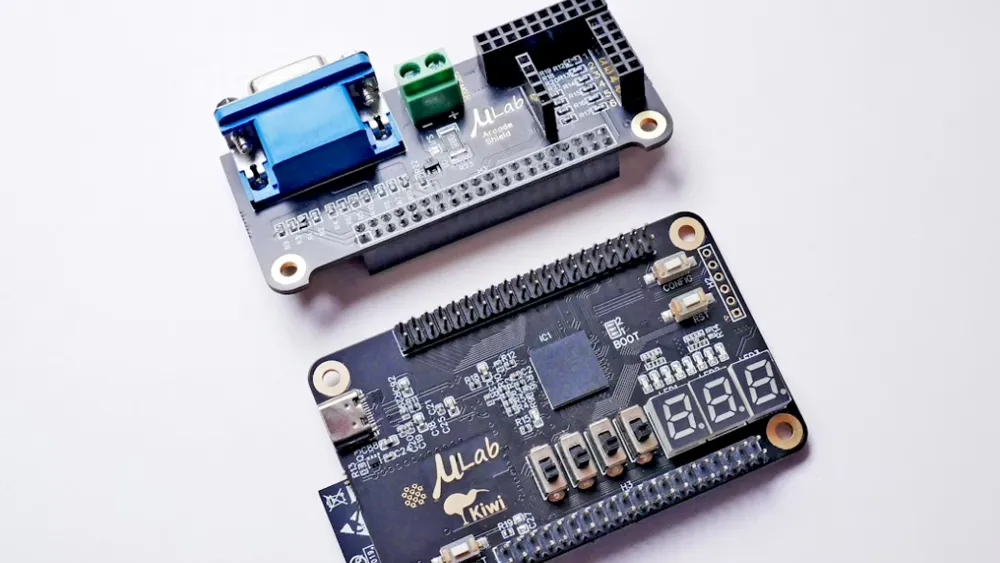

1. rcm certification

(1) What is RCM Certification?

RCM certification is a mandatory certification for the import and export of electrical and electronic products to Australia.

Since March 1, 2013, Australia and New Zealand have implemented the unified Electrical Equipment Safety System (EESS).

Electrical and electronic products on the Australian and New Zealand markets must comply with local safety and Electromagnetic Compatibility (EMC) technical standards and certification requirements, and bear the unified compliance mark—the rcm mark—before the products can be circulated in the market.

(2) Risk Level Classification of Electrical and Electronic Products (for Australian Certification Application)

Based on the inherent risks of products, they are classified into three categories:

① Low-Risk Equipment (Level 1):

Suppliers must ensure products comply with relevant safety standards and retain compliance evidence for five years after products are discontinued from sale.

Reference Standard: AS/NZS 3820

② Medium-Risk Equipment (Level 2):

Products must have a test report issued by an accredited testing laboratory, and product information must be registered in the EESS database.

Reference Standard: AS/NZS 4417.2

Products include: air conditioners, portable luminaires, projectors, electrical appliance connectors, lampholders, fluorescent lamp ballasts, etc.

③ High-Risk Equipment (Level 3):

Products must have a test report issued by an accredited testing laboratory, undergo product certification at a designated conformity assessment body to obtain a Certificate of Conformity (CoC), and product information must be registered in the EESS database.

Reference Standard: AS/NZS 4417.2

Products include: electrical appliance connectors, arc welding machines, bayonet lampholders, bayonet lampholder adapters, toasters, clothes dryers, etc.

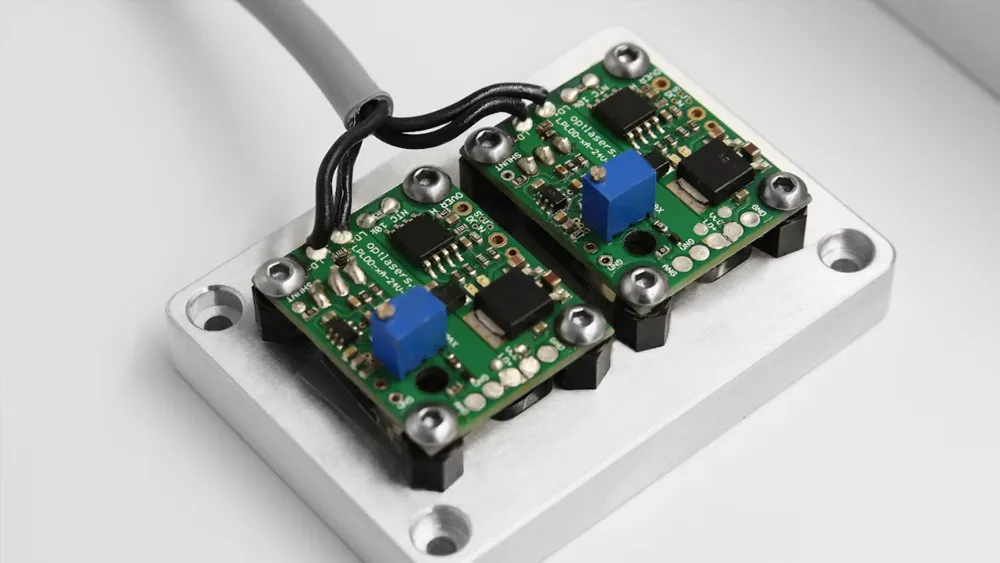

2. saa certification

(1) What is SAA Certification?

SAA certification is a mandatory certification for electrical and electronic products in Australia, ensuring products meet Australian safety standards.

This means all electrical and electronic products on Amazon Australia must pass SAA certification and be marked with the certification certificate number.

In addition, due to the mutual recognition agreement on standards signed between Australia and New Zealand, products that obtain SAA certification in one country may be sold in the other.

(2) Common SAA Certification Standards

① AS/NZS 60950: Safety requirements for information technology equipment

② AS/NZS 60065: Safety requirements for audio, video and similar electronic apparatus

③ AS/NZS 60598.1: General safety requirements for luminaires

④ AS/NZS 60598.2.x: x represents a number, with different numbers corresponding to different types of luminaires

⑤ AS/NZS 61347.1: Safety requirements for lamp control gear

⑥ AS/NZS 61347.2.x: x represents a number, with different numbers corresponding to different types of control gear

⑦ AS/NZS 60335.1: General safety requirements for household and similar electrical appliances

⑧ AS/NZS 60335.2.x: x represents a number, with different numbers corresponding to different types of household appliances

*SAA certification standards start with AS/NZS. Their content is generally consistent with the standards of the International Electrotechnical Commission (IEC), but there are some national variations.

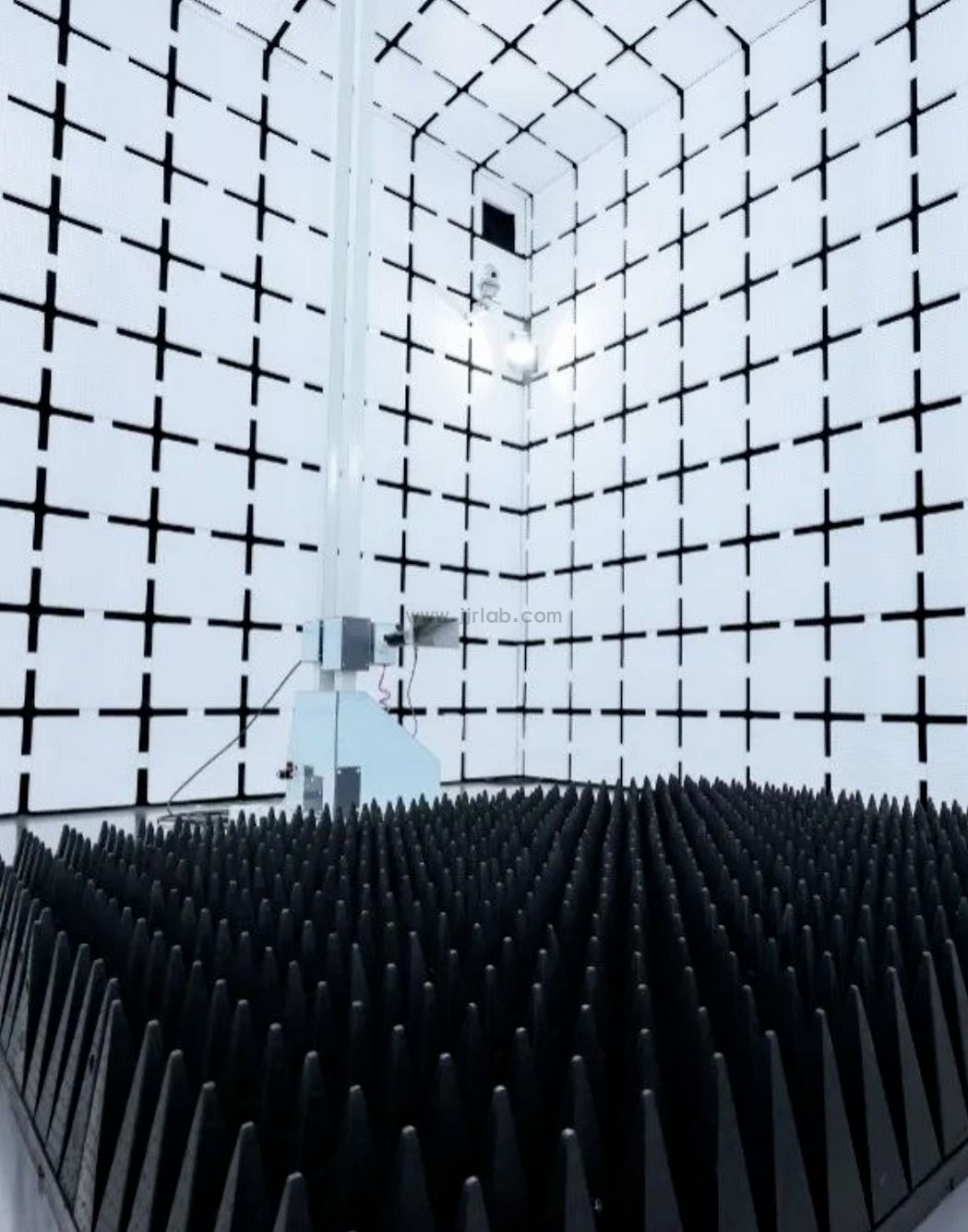

3. c-tick certification

C-TICK certification is an electromagnetic compatibility certification for electronic products in Australia, which has now been integrated into the more comprehensive RCM system.

It is worth noting that for certain specific product categories with low interference to the radio spectrum, such as manual switches, simple relays, single-phase squirrel-cage induction motors, and resistors, voluntary application for the use of the C-TICK mark is still permitted.

Australian C-TICK Electromagnetic Compatibility + SAA Safety Certification = RCM Certification

Email:hello@jjrlab.com

Write your message here and send it to us

Canada ISED Certification RSS-247 Standard Testing

Canada ISED Certification RSS-247 Standard Testing

What Are the Product Compliance for Amazon Austral

What Are the Product Compliance for Amazon Austral

Australia IoT Security Compliance

Australia IoT Security Compliance

V16 Warning Light EU EN 18031 Cybersecurity Certif

V16 Warning Light EU EN 18031 Cybersecurity Certif

Japan IoT Security JC-STAR Certification

Japan IoT Security JC-STAR Certification

FCC SDoC Compliance Information Statement

FCC SDoC Compliance Information Statement

What Does FCC SDoC Certification Mean?

What Does FCC SDoC Certification Mean?

What is Bisphenol A (BPA) Testing?

What is Bisphenol A (BPA) Testing?

Leave us a message

24-hour online customer service at any time to respond, so that you worry!